When tariffs on Asian imports climb from 10% to 20%, 30%, or even 55%, manufacturers face immediate pressure on margins, pricing, and supply chain resilience. For companies in North America and Europe, these shifts raise urgent questions: How much will tariffs add to production costs? Which sourcing hubs remain viable? Should I be changing my manufacturing strategy?

In this article, we take a closer look at the current tariff landscape, the risks manufacturers face, and the options available to stay competitive.

The real impact of tariffs comes down to three factors: how your products are classified, where your suppliers are located, and what your current margins look like. While that might sound complex, the process of calculating tariff exposure is straightforward once you break it down.

Start by finding your products’ classification codes. The Harmonized System (HS), Harmonized Tariff Schedule (HTS), and Schedule B are all related systems based on the international HS standards: HS codes are used globally, HTS codes are required for U.S. imports, and Schedule B codes are needed for U.S. exports.

Every product has one, and tariff rates are applied directly to those classifications. From there, check the current tariff rate for each supplier country.

The next step is to calculate the tariff burden as a share of your total landed cost—not just the unit price of the product. This includes freight, insurance, duties, and compliance overhead. Looking only at unit price can dramatically understate the true impact on profitability.

Finally, model alternate sourcing scenarios. For example, could shifting to a domestic or multi-country supply strategy reduce your risk? Would higher volumes justify switching suppliers even if the unit price increases? And if you can’t absorb the tariff costs internally, what happens when you pass them on to customers?

Tariffs don’t automatically make your suppliers unviable. The question is whether their total value proposition (quality, speed, reliability, and cost after duties) still compares favorably to alternatives.

Start by calculating total landed cost with tariffs included, then compare it against what you would pay with other suppliers. But remember: switching isn’t just about price. It can introduce risks around quality, new tooling costs, and disruption to established processes.

It’s also important to evaluate your supplier’s ability to support changes in demand during a transition. Many manufacturers underestimate how complex and disruptive supplier shifts can be, especially with intricate or regulated products.

Finally, have direct conversations with your current suppliers. Ask whether they can manufacture in multiple countries, source components from other regions, or offer hybrid production models. These discussions often uncover untapped flexibility that helps reduce tariff exposure without losing the benefits of long-standing relationships.

Even with a range of tariffs, Asia often remains the most competitive option for technical products. That’s because the region offers something few others can match: deeply integrated supplier networks, world-class logistics, and specialized expertise.

For electronics and precision manufacturing, Asian suppliers typically deliver higher technical capability compared to alternatives. They also scale more efficiently, handling volume swings up to ten times larger than what most competitors can manage. Combined with supply chains that can often cut time-to-market, the value often outweighs tariff costs.

Asian sourcing tends to make the most sense for complex, high-value products; items requiring specialized processes; or components where speed and reliability are critical. In these cases, even significant tariffs don’t erase the advantages of an established, integrated ecosystem.

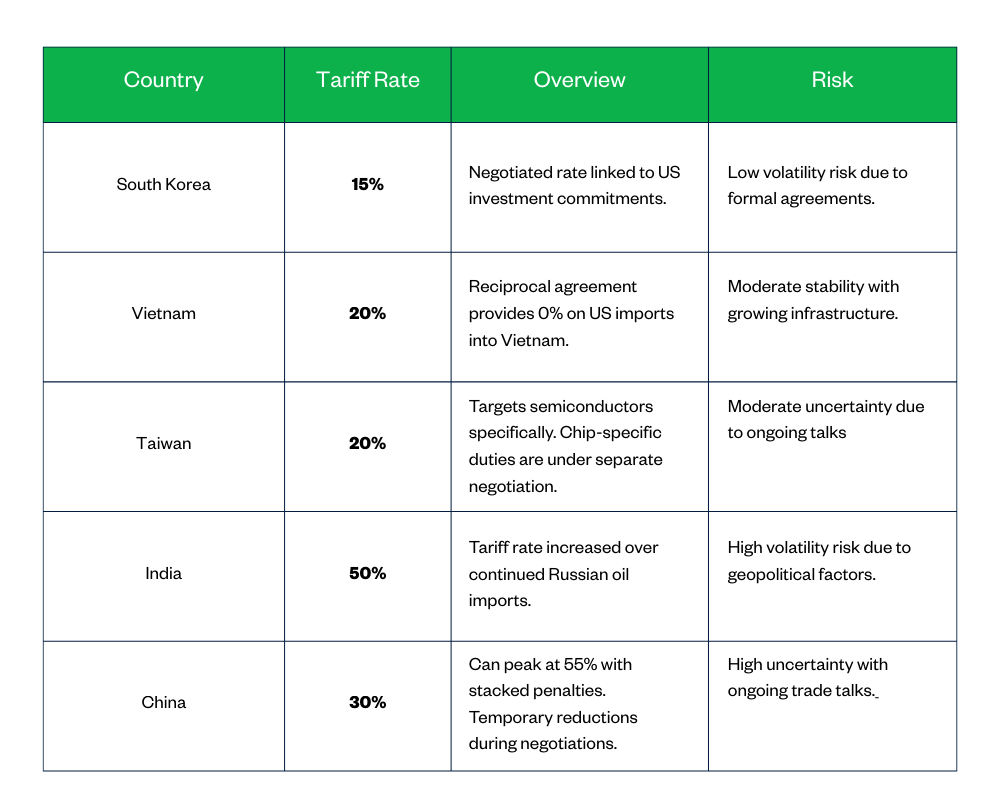

South Korea has the lowest tariffs at 15%, followed by Vietnam and Taiwan at 20%, while China currently stands at 30% during negotiations.

Current tariff snapshot (August 2025):

South Korea:

Currently there is a 15% US tariff rate on most goods, established through recent trade agreements that include major US investment and energy purchase commitments. Certain sectors, like steel and aluminum, may still face higher tariffs. This rate arrangement is considered stable and predictable for manufacturers planning costs.

Vietnam:

The standard US tariff on Vietnamese goods is 20%; however, goods transshipped through Vietnam from another origin may face up to 40% duties. A reciprocal agreement ensures US exports to Vietnam are tariff-free (0%), which is advantageous for companies operating in both markets. While Vietnam’s trade infrastructure and rule enforcement are improving, tariff stability is moderate due to some pending regulatory clarifications.

Taiwan:

US tariffs on most Taiwanese goods, including semiconductors and electronics, are set at 20%, with any goods found to be transshipped to evade applicable duties subject to an additional 40% tariff. Product-specific tariffs, especially on chips, are still being negotiated, introducing some uncertainty for high-tech industries.

India:

US tariffs on Indian goods have been raised to 50% following an August 2025 executive order targeting India's Russian oil purchases. These elevated rates, among the highest imposed, primarily affect textiles, jewelry, chemicals, and furniture, creating substantial volatility for companies seeking reliable US market access.

China:

The tariff environment in China is highly complex. The average US tariff on Chinese imports is currently between 30 and 34% in what is being referred to as an active negotiation “truce,” but cumulative penalties under various US trade laws can push total rates up to 55% for certain categories. These conditions are subject to ongoing negotiations and could change rapidly, making sourcing from China unpredictable and high risk.

Shifting production to another Asian country can reduce tariff exposure, but success rarely comes from moving everything at once. Instead, it depends on component-level analysis: deciding which parts are best made where and how those pieces fit into your broader supply chain.

Each country offers unique strengths: China for complex technical products and integrated supply chains, Taiwan for high-tech electronics and precision components, Vietnam for cost-efficient assembly with growing capability, South Korea for advanced electronics and automotive components, and India for scale and domestic market access.

Often the most effective strategy is hybrid. For example, a company might source electronics from Taiwan, plastic parts from Vietnam, and complete final assembly in Mexico. Or they might rely on China’s supply chain strengths but move finishing steps elsewhere to balance cost and compliance.

Country-of-origin status requires 'substantial transformation,' meaning enough processing to change the product's tariff classification or add significant local value. This can involve processing that changes the product's HTS code classification.

Vietnam, for example, is formalizing a 30% local content requirement where final assembly operations must meaningfully alter the product's character. Simple assembly or repackaging won't qualify for Vietnamese origin status.

Documentation becomes critical throughout this process. You'll need detailed records proving substantial transformation occurred in Vietnam rather than just final touches. Companies that push boundaries risk customs disputes and penalties, while conservative, well-documented approaches provide long-term security.

The practical step is working with customs experts to determine what level of processing qualifies for your specific products before committing to a sourcing strategy. Understanding these requirements upfront prevents costly surprises later.

The best defense against policy shifts is flexibility. That means building supply chains that span multiple regions and maintaining relationships with suppliers you don’t yet “need.” Many manufacturers are already moving production to alternate locations, not because it’s cheaper, but because it reduces risk if new restrictions appear.

Pre-qualifying suppliers, testing alternative materials, and stockpiling critical components are all part of this strategy. Modular product design can also help, making it easier to substitute regional components or improve shipping efficiency.

One client of ours manufactured children’s ride-on suitcases with a curved, ladybug-like design. The shape meant only 20 units fit in a shipping container. By redesigning the cases to nest inside each other, capacity jumped to 80 units, cutting shipping costs by 75% without sacrificing appeal. Small design shifts like this can unlock major resilience in global logistics.

At some point, the complexity of tariffs, origin rules, and multi-country sourcing goes beyond what most internal teams can manage. That’s when outside expertise becomes essential.

The right partner should have established relationships across multiple Asian hubs, experience navigating past trade disruptions, and the ability to match specific components with the most advantageous manufacturing locations. They should also help interpret customs regulations, monitor shifting policies, and provide hands-on support from planning to production.

With over 42 years in Asian manufacturing, Kingstec offers exactly that. Our network spans China, Taiwan, and Vietnam, and our component-level optimization ensures each part of your product is made where it makes the most sense—financially, logistically, and strategically.

The tariff landscape will continue evolving, but manufacturers who build flexible, well-informed strategies can adapt and thrive. Contact Kingstec today to discuss how we can help you navigate these challenges and build a resilient manufacturing strategy.